The restructuring plan is the central element of StaRUG. The non-public restructuring procedure gains attractiveness in particular by the fact that the involvement of the restructuring court is possible, but not mandatory. Find out more about the restructuring plan here.

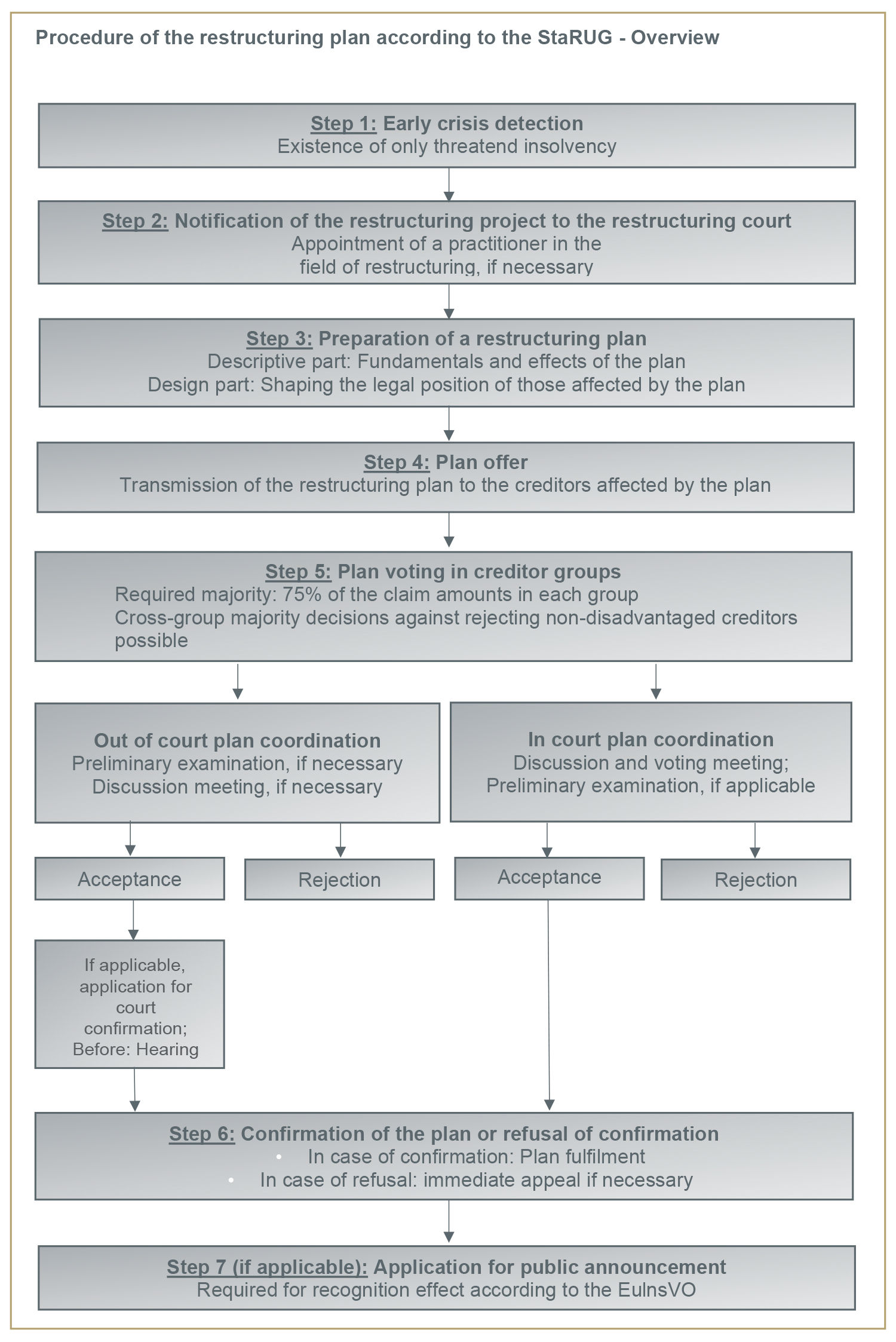

Procedure of the restructuring plan in detail:

- Early crisis detection

- Notification of the restructuring project to the restructuring court

- Preparation of a restructuring plan

- Submission of the plan offer

- Plan coordination in creditor groups

- Confirmation of the restructuring plan or refusal of confirmation

- Request for public announcement, if applicable

1. Early crisis detection

The earlier a company seizes restructuring opportunities, the more room for manoeuvre there is and the more likely it is that the restructuring will be successful. This premise is, of course, not new.

The decisive prerequisite for a reorganisation by means of a restructuring plan according to StaRUG is that the company is only threatened with insolvency. If, on the other hand, it is already illiquid and/or overindebted, it is obliged to file for insolvency and only restructuring within the framework of insolvency proceedings can be considered.

Moreover, the restructuring plan under StaRUG is usually suitable in these situations:

2. Notification of the restructuring project to the restructuring court

If the company wishes to make use of one or more procedural aids of StaRUG to support its reorganisation by means of a restructuring plan, it is a prerequisite that the restructuring project be notified to the competent restructuring court. With the notification, the restructuring case becomes legally pending. The notification is not an application to be decided by the court, but merely a unilateral procedural act by the debtor. However, the debtor must attach the following documents with the notification:

- Draft restructuring plan or concept, if the plan has not yet been drawn up.

- Presentation of the status of the negotiations/presentation of the arrangements for the fulfilment of the obligations under StaRUG.

- Explanation of whether and how the rights of consumers or SMEs are to be interfered with.

With the notification of the restructuring project (or even in a further step), the debtor can apply for the selected procedural aid. StaRUG provides for the following restructuring instruments:

- ordering of enforcement and realisation freezes (so-called "stabilisation"),

- preliminary examination of issues relevant to the confirmability of the restructuring plan,

- execution of the judicial reconciliation of the plan

- Confirmation of the restructuring plan (recommended if the plan has been agreed out of court).

3. Preparation of a restructuring plan

If a prepared draft plan is not yet available at the time of notification of the restructuring procedure, the restructuring plan must be prepared in the next step.

a. Formable legal relationships

When drawing up a restructuring plan, the primary concern is how existing legal relationships can be restructured in order to ensure the preservation of the company. However, only the following legal relationships can be shaped by the restructuring plan:

- so-called restructuring claims, i.e. claims that are established against the debtor at the time the restructuring plan is submitted, even if they are conditional or not yet due,

- so-called rights to separate satisfaction, i.e. rights to objects existing at the time of submission of the restructuring plan, which would entitle the debtor to separate satisfaction in the event of the opening of insolvency proceedings (examples: land charges, ownership by way of security)

- provisions arising from multilateral legal relationships between the debtor and several creditors,

- provisions arising from different legal relationships regulating creditors' rights among themselves,

- Share or membership rights in the debtor (example: GmbH shares),

- third-party securities of affiliated companies.

The restructuring procedure is not a general enforcement procedure, i.e. only certain creditors, e.g. financial creditors, can be included in the restructuring plan.

The following are excluded from the restructuring option from the outset:

- Claims of employees in connection with the employment relationship, in particular from company pension schemes,

- claims arising from unlawful acts committed intentionally and from fines, penalties, administrative fines, etc. under section 39 (1) no. 3 InsO,

In addition, there is no possibility under StaRUG to terminate contracts prematurely, especially in the case of tenancies.

b. Contents of the restructuring plan

The restructuring plan is divided into a

- a declaratory part and

- a constructive part.

Declaratory part

The declaratory part contains the fundamentals and effects of the restructuring plan. It thus serves to inform the parties affected by the plan, i.e. the creditors whose rights are to be regulated in the plan, as well as the restructuring court.

In particular, the following must be stated

- the causes of the crisis,

- the restructuring concept,

- a comparative calculation (presentation of the effects of the plan on the prospects of satisfaction of the parties affected by the plan; depending on whether the purpose is the continuation or liquidation of the enterprise, using continuation or liquidation values),

- Selection of parties affected by the plan (according to criteria defined by law),

- Formation of groups (according to legally defined criteria; e.g.: potential beneficiaries of separation, holders of subordinated claims, shareholders, etc.).

Constructive part

The contructive part determines the consequences for the parties affected by the plan. Unless stipulated otherwise in the restructuring plan, the satisfaction of the creditors provided for in the constructive part releases the enterprise from its remaining liabilities.

Therefore, the following restructuring measures must be stated in particular

- reductions in claims and

- deferrals.

In addition, provisions on new financing, e.g. on the commitment of loans or other credits required for restructuring on the basis of the plan, as well as their collateralisation, may also be included. The inclusion of new financing must be justified accordingly.

4. Submission of the plan offer

Irrespective of whether the vote on the restructuring plan takes place out of court or in court, the so-called plan offer must be sent to the parties affected by the plan in advance of the vote.

The plan offer must contain the following in particular

- the complete restructuring plan together with annexes,

- a reference to the fact that the plan, if accepted by a majority and confirmed by the court, will also become effective vis-à-vis the creditors who have not approved of the plan,

- a description of the costs of the restructuring proceedings already incurred or still to be expected (including, if applicable, the remuneration of the restructuring agent).

If the vote on the restructuring plan (see below) is to take place in writing at the out-of-court meeting, the plan offer must additionally include

5. Vote in creditor groups

The submission of the plan offer is followed by the vote on the restructuring plan. The company has the choice whether this is done with or without the involvement of the court.

a. Out-of-court vote on the restructuring plan

The out-of-court vote is organised privately by the company. It presides over the meeting.

The invitation to the parties affected by the plan must be

- in writing,

- with a notice period of 14 days (7 days in the case of electronic participation).

Practice Note by Dr. Jana Julia Hübler:

The company can also hold a meeting electronically, e.g. by means of a video conference. In this case, it must be ensured that the technical requirements are met and that all plan participants are able to perceive all essential processes of the meeting, to express themselves and to communicate (also with other participants). Technical transmission difficulties shall be the responsibility of the company and, in case of doubt, it must prove that the reasons for the transmission difficulties do not lie within its sphere of responsibility.

The restructuring plan may be amended in individual points during the meeting. In general, requests for amendments must be submitted to the company at least one day before the beginning of the meeting. The company may, but is not obliged to, accept proposals for amendments that are received late or that are not submitted until the meeting.

b. Judicial vote on the restructuring plan

The court plan vote takes place within the framework of a so-called discussion and voting meeting. In this meeting, both the restructuring plan and the voting rights of the parties affected by the plan can be discussed. The vote on the plan then takes place.

Practice Note by Dr. Jana Julia Hübler:

The advantage of a court confirmation of the plan is that disputes about the proper conduct of the voting procedure can be avoided in advance, which could lead to the refusal of plan confirmation.

c. Formation of the required majority

Voting shall take place according to the groups specified in the restructuring plan.

Voting rights

The parties affected by the restructuring plan shall decide on the acceptance or rejection of the restructuring plan by means of a vote in accordance with their voting rights. These are based on the following criteria

Right of the party concerned | Criterion |

|---|---|

Restructuring claims | Amount of the claim |

Right to separate satisfaction and intra-group third-party securities | Value of the asset or collateral |

Share/membership rights | Share of the debtor's subscribed capital or assets |

Required majority

The restructuring plan is adopted if, in each group, the group members approving the plan hold at least 75% of the voting rights in that group.

Minority protection

If the required majority is not reached in a group, StaRUG provides for a prohibition of obstruction, so-called cross class cram down. According to this, the consent of a group is deemed to be granted under the following conditions if:

6. Confirmation of the restructuring plan or refusal of confirmation

a. Confirmation of the plan

In order for the effects stipulated in the restructuring plan to also take effect vis-à-vis those creditors who have voted against the restructuring plan, a court confirmation of the plan is required. This is only done at the request of the company.

If confirmation of a restructuring plan accepted out of court is applied for, the following must be attached to the application

- the restructuring plan put to the vote together with the annexes,

- the documentation on the result of the vote and

- all documents and other evidence showing how the vote was conducted or the result of the vote.

The prior hearing of the parties affected by the plan by the restructuring court is possible in the case of a court plan vote, in the case of an out-of-court vote it is mandatory.

b. Refusal of confirmation

The restructuring court may refuse to confirm the restructuring plan ex officio if

- the enterprise is not threatened with insolvency,

- the requirements of the restructuring plan or the plan coordination have been violated and the defect cannot be remedied within a reasonable period of time,

- the claims of the parties affected by the plan, which are formed by the plan, obviously cannot be met.

The company has the right of immediate appeal against the refusal.

7. Request for public announcement, if applicable

Restructuring by means of a restructuring plan under StaRUG is generally not public. However, the debtor can apply for public disclosure. However, the relevant regulations will not enter into force until 17 July 2022.

Practice Note by Dr. Jana Julia Hübler:

Public announcements are particularly necessary if the company maintains foreign business relations and seeks recognition under the provisions of the EuInsVO.

Dr. Jana Julia Hübler

Author of this article

Dr. Jana Julia Hübler is a lawyer in our Cologne office and works in the field of insolvency administration and insolvency and restructuring law. Her main areas of expertise include the handling of insolvency proceedings in a wide range of business sectors as well as the continuation and restructuring of illiquid companies.

She is, inter alia, the author of Nerlich/Römermann, Kommentar zum StaRUG, which will be published in the course of 2021.